Posted by François Auré in Exchange Rates Today, Morning Preview, –

– “USD mixed as bid for havens is offset by European data beats. CAD resists risk-driven drop in commodity peers; EUR ticks higher on PMIs beat but details warrant caution. GBP out-performs as PMIs steady on easing political uncertainty. JPY makes minor gains but struggles to move away from 112 mark. AUD and NZD lead G-10 losses in risk-off mood, former reaches 11-yr low. MXN slides to 19.00 mark on risk aversion, lags all majors.” Scotiabank

– The Pound to Euro exchange rate was quoted at €1.1942 on 21.02.2020

– The Pound to US Dollar exchange rate was quoted at $1.2890 on 21.02.2020

Pound Sterling (GBP) Exchange Rates

The British Pound exchange rates suffered from another extremely rough day of trade on Thursday with the Pound to Dollar exchange rate (GBP/USD) tumbling below the $1.29 handle.

It has been a strange week for the GBP as UK retail sales came in above forecast alongside better than expected inflation, but GBP/USD has been declining strongly.

A lot of this is the powerful performance from the US Dollar, but it also represents how Brexit talks have reclaimed their position as the most important fundamental for Sterling moving forward.

“It was noticeable that GBP was slightly weaker vs both USD and EUR despite much stronger-than-expected retail sales for January (including petrol, +0.9% mom vs +0.7% expected, previous -0.5%)” asks Marshall Gittler, analyst at BDSwiss. “This was the largest gain since last March. This indicates continued Brexit fears.”

Euro (EUR) Exchange Rates

The Euro lost another support on Thursday as the EUR/USD exchange rate slipped beneath the 1.08 handle.

Bearish sentiment has been gathering steam, and exposure to China during the recent health crisis has seen the Eurozone hit far worse than the U.S. so far as the automobile demand has dried up.

It’s therefore not particularly surprising that the Euro x-rates would struggle, but with plenty of investors hoping the floor was in, those troubles have been exaggerated.

US Dollar (USD) Exchange Rates

It has been quite a ride for the Dollar index this year, with the measure up more than 3% year to date.

Obviously, the Euro has been a major contributing factor for this, but the Japanese Yen has also been a significant contributor, as USD/JPY hit above 112 on Thursday.

The potent mix of shelter, stability, and yield continue to make this the world’s most sought after currency and its very hard to see how that can change.

A dramatic shift from the Fed is one possibility, but this so far looks unlikely while asset prices remain high.

OTHER MAJORS

Both the New Zealand Dollar and Australian Dollar are taking the full brunt of the slow-down in Asia, with the AUD and NZD dropping to 90-day lows. Dramatic weakness in the Chinese Yuan has also been seen, as USD/CNH continues to spike as Beijing seeks to alleviate the damage from the health crisis.

While the Canadian Dollar has not been particularly strong, it has been performing well enough. Analysts at ING believe that it still stands to be one of the best performers among G10 exchange rates, should risk appetite in FX come back,

“Covid-19 and a generally-strong dollar are set to limit USD/CAD downside for now, although the loonie is still likely to outperform the more China-exposed Australian dollar and New Zealand dollar. In the longer-term CAD has all the cards in order (above all, an attractive carry) to be the key G10 outperformer once risk aversion dissipates.”

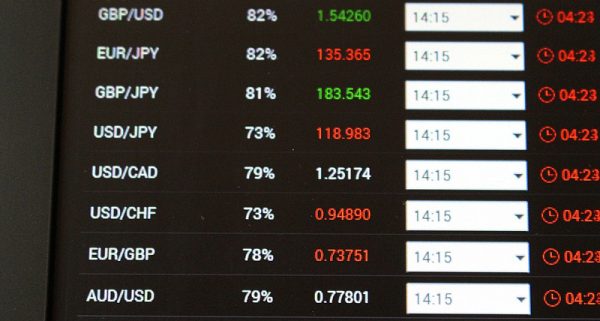

“So why is JPY, a well-known “safe haven” currency, down too when CHF, the other safe haven, is up?” asks Gittler. “I think the reason is clear: people are worried about the risk of recession in Japan. That’s outweighing “risk off” support for the yen. In other words, people have finally realized that the real risk here is to Japan. This graph gives a rough guide to each country’s exposure to China through its exports.”

Image: Exports to China

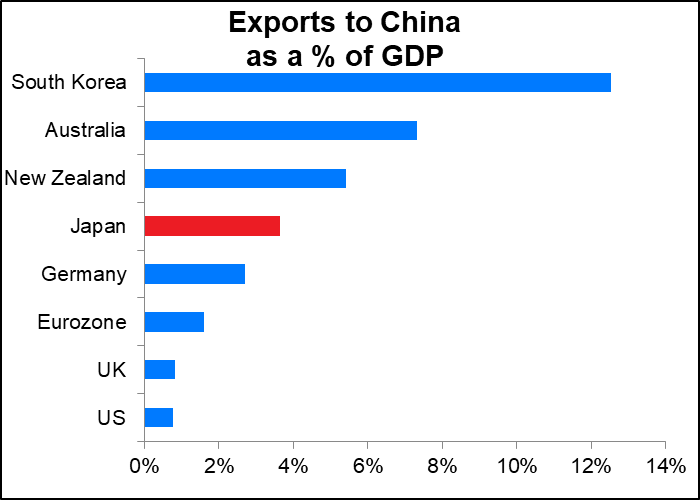

“The graph below shows that since February, JPY has not been trading like a “safe haven” currency, but rather has traded in line with the other countries affected by the China slump” continues Gittler. “(Note that AUD and NZD have been turned around from the way they’re usually quoted.) It’s also curious that KRW, which in theory should be the hardest-hit, has actually weakened the least. But I’m not an emerging market specialist and I have no idea why this is – maybe it’s because of exchange controls in the country.”

Image: USD vs currencies most affected by COVID-19 (Novel Coronavirus 2019)

CORONAVIRUS UPDATE

Coronavirus outbreak in a several prisons in China has raised the alarm after Chinese authorities reported over 500 new coronavirus cases inside prisons.

Dozens of protesters in a Ukrainian town have attacked buses carrying 45 Ukrainians and 27 foreign nationals who had been flown from Wuhanbeing and taken to a hospital in Novi Sanzhary, central Poltava.

Cases in South Korea have doubled focused on a church and hospital in the southern city of Daegu.

THE DAY AHEAD

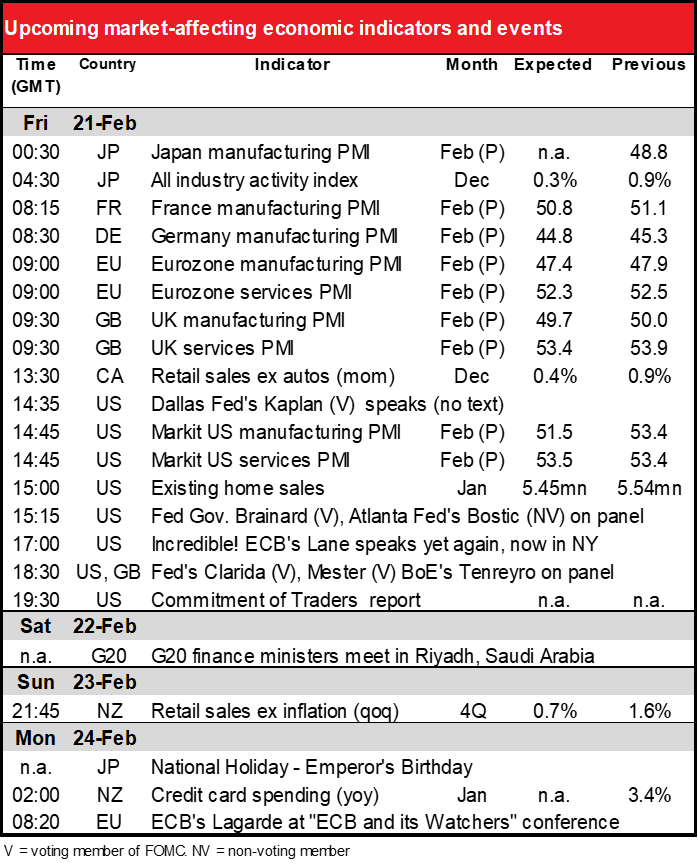

Image: Forex calendar 21/02/2020

There is plenty of economic data today, manufacturing PMIs in Germany and the UK are on tap, while the Eurozone will also release its CPI (inflation) data.

“The UK PMIs are also expected to be lower, but not by that much” comments Gittler on Friday, February 21. “The manufacturing PMI is forecast to just dip below the “boom or bust” line of 50. However, this is probably not weak enough to call for a rate cut from the Bank of England. I therefore expect these small declines to be neutral for GBP.”

In the U.S. more PMI’s are available while existing home sales data is also important reading for the USD.

Advertisement

Save money on your currency transfers with TorFX, voted International Money Transfer Provider of the Year 2016, 2017 and 2018. Their goal is to connect clients with ultra competitive exchange rates and a uniquely dedicated service whether they choose to trade online or over the telephone. Find out more .

Advertisement